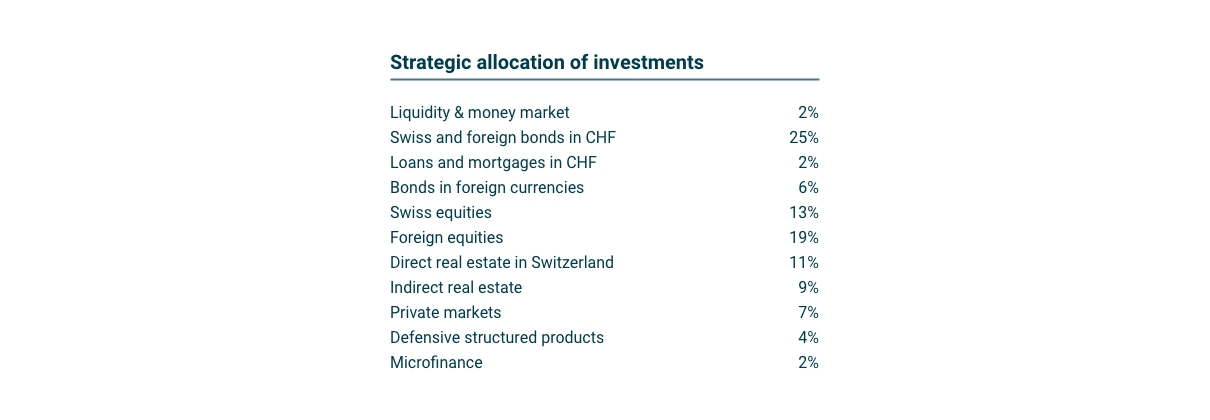

Cautious and responsible

- A sustainable and sound capital management policy

- Rigorous selection of investment vehicles

- ESG (environment, social and governance) factors applied to all investment activity

- Regular assessments with "light green" or A ratings

- Above average performance