Flexible hospitalisation insurance

- Before each stay in hospital, you can choose your level of coverage (general, semi-private or private ward).

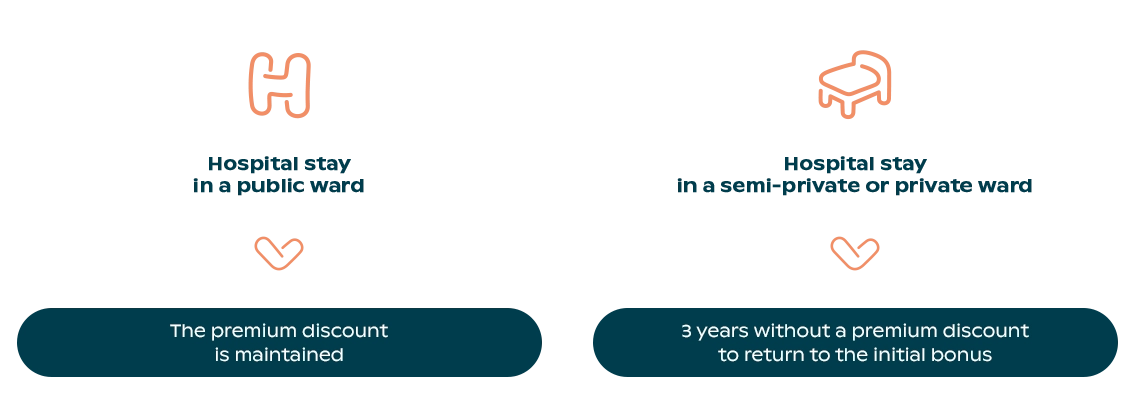

- You benefit from a 20% discount on your monthly premium, from the moment you sign the contract, as long as you are not hospitalised in a semi-private or private ward.

- You are free to choose your doctor and the hospital where you will be treated, from the list of recognised hospitals.