Incapacity for work

Has an illness or accident prevented you from working for an extended period? Is your salary guaranteed in the event of incapacity for work?

Has an illness or accident prevented you from working for an extended period? Is your salary guaranteed in the event of incapacity for work?

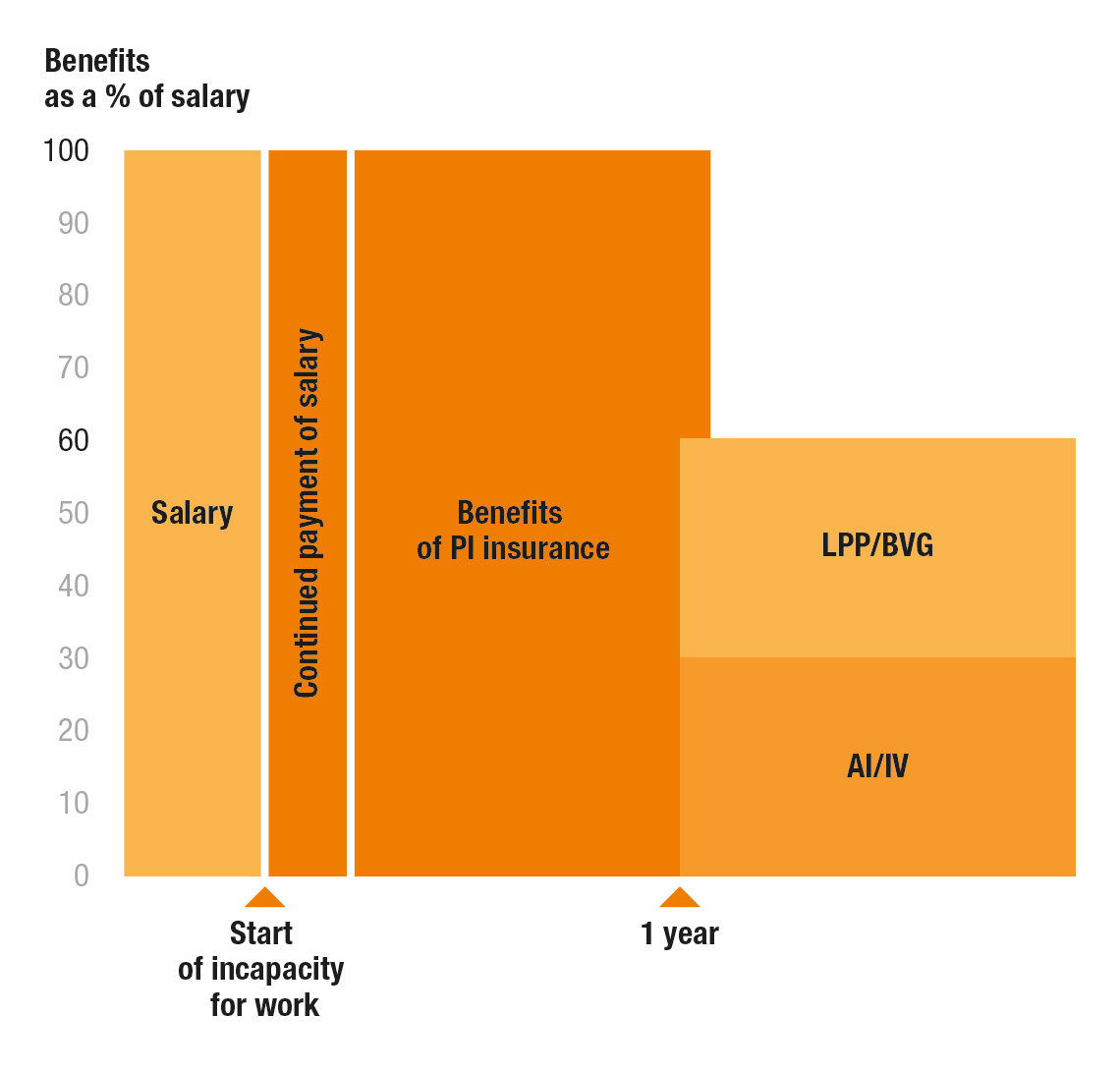

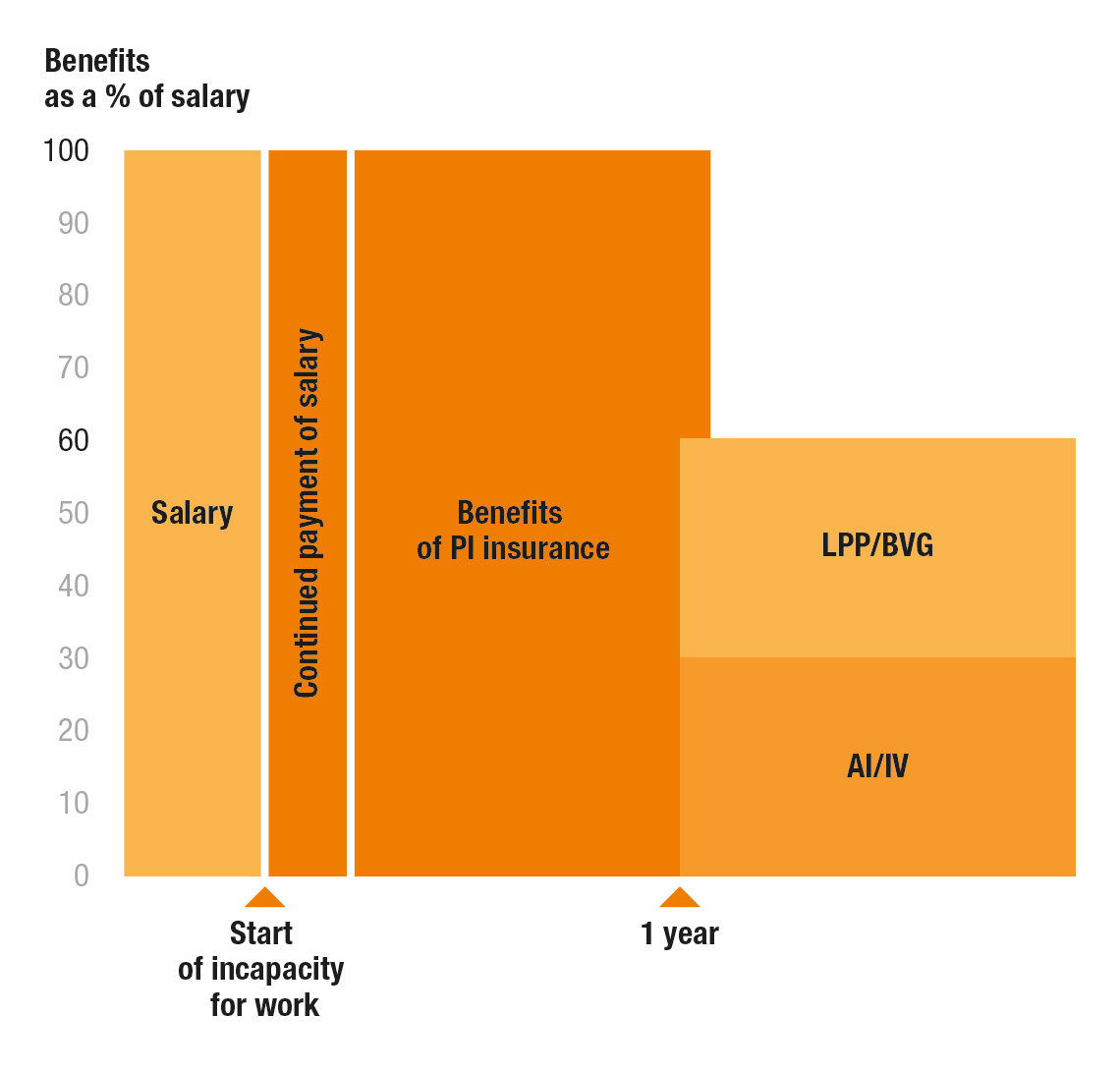

In the event of incapacity for work following an illness, your employer is required by law to pay your salary during a limited period of time: three weeks during the first year of employment. This period increases progressively with the number of years of employment.

Once the period has lapsed, payment of your salary will cease. As a general rule, it will be replaced by a daily subsistence allowance from the group insurance contracted by your employer. You are entitled to the allowance until your disability insurance annuity or pension fund begins, or until the termination of the group insurance.

Daily subsistence insurance for illness is not compulsory in Switzerland. Your employer may have failed to take out such an insurance for his/her employers, or the insurance may not have provided sufficient coverage. There is therefore a risk that you will be without any income in the period between the end of the right to a salary (group daily subsistence allowance) and the beginning of the disability annuity.

In the event you are incapacitated for work due to an accident, the compulsory accident insurance will pay out a daily subsistence allowance equivalent to 80% of your salary from the third day following the date of the accident. In the event you are partially incapacitated for work, the insurance will pay out a proportionately reduced subsistence allowance.

By subscribing to our individual insurance, you benefit from a daily allowance in the event of illness or an accident. In the event that you are no longer able to work, the insurance will pay you an allowance at the end of the waiting period.

You can tailor the individual insurance for the daily allowance in accordance with your requirements: you can freely choose the amount and number of days you wish to benefit from the daily allowance (up to a maximum of 730 days) and the waiting period before receiving your first allowance.

Discover the benefits our insurance provides and how it works in detail.

If you are self-employed, you must take out an individual insurance against accidents, old age, disability and loss of income.

To protect yourself against loss of income, you can subscribe to an individual insurance for a daily allowance in the event of illness or an accident. However, we advise you to take out a combined insurance policy for self-employed persons. In this way, you will cover all your insurance requirements with one product.

You can find all information relating to insurance for self-employed persons on the following page: Insurance cover for self-employed persons.

Do you have any questions about daily allowance insurance?

Our insurance advisers are available to answer any questions you may have.

Share